That is completely up to you. If you don’t choose to pre-plan, your family will likely choose what type of service you have. Typically, they are held at a place of worship or a funeral home. Some people have religious rituals or ceremonies that they want at their funeral. The service is also a time for friends and family to remember and celebrate their loved one. Some people choose a private service which is invitation only where select relatives and friends attend the service. Others choose a memorial service which does not have the body present and can vary in ceremony structure depending on your community and religious beliefs.

For many people, a public viewing is a part of a cultural and/or ethinic tradition. A viewing can also aid in the grief process by helping people realize the reality of death. However, the choice is entirely yours. Some people prefer to not have a viewing.

Having an obituary notice can be helpful for friends and the community to be notified about the death and the type of service to be helped. Obituaries can be placed in the newspaper or online.

Vaults are not required by law but they are required by most cemeteries. They require caskets to be placed in a burial vault in order to prevent the ground from sinking above the casket.

Funeral directors provide administrative services, such as making the arrangements for transportation of the body, completing paperwork, implementing funeral choices. They also provide caregiving services by being listeners, advisors, and supporters for the family. They are trained to answer questions about grief and provide sources of professional help to those struggling, if needed.

Yes, cremation is simply an option for the final disposition of the body. You can still have a visitation period and funeral service.

The median funeral cost in 2019 was $9,135, not including the cost of the cemetery and cash advance charges, such as flowers or an obituary (National Funeral Directors Association 19 Dec. 2019). The cost of a funeral varies based upon your choices. For example, a burial is more expensive than a cremation and some caskets are more expensive than others.

In a way a funeral is a lot like a wedding or a special birthday celebration, it is a major life event. The type and cost of the funeral varies depending on the preferences of the consumer. Additionally, funeral homes are a 24-hour, labor intensive business with extensive facilities. There are also services included in the cost such as filing appropriate forms, dealing with doctors, ministers, florists, newspapers, etc. All of these factors go into the cost of a funeral.

Our funeral concierge services assist your family at the time of need to ensure that the prices being offered to your family are reasonable and fair. Specialists like Mark Turner have years of funeral experience and will work to advocate for your family.

There are a variety of reasons why people choose to pre-plan their funeral. Some people want to spare their loved ones from having to make tough emotional and financial decisions at the time of passing. Others have strong preferences for their funeral that they want to ensure are honored. Pre-planning also may allow people to reduce their total assets to qualify for Medicaid benefits or other public assistance. These are just a few of the reasons why people choose to pre-plan.

Nope! With our funeral planning services, you are not making funeral arrangements with a particular funeral home. Our funeral planning services and funds can be used at any funeral home of your choosing AND you can change which home at any time. You have the flexibility to determine where the funds go and how they are used. This also allows you to compare the costs of multiple funeral homes and pick the one that is best for you and your family.

You are able to prepay for your funeral by using a guaranteed issue life insurance policy with a single pay, 1, 3, 5 or 10 year payment terms. This is also known as pre-need insurance. Local expert Mark Turner from Legacy of Love can provide details and options.

When you pre-plan with a funeral home, they typically take your money and invest it into an insurance product called a funeral trust.

With our plan you purchase a limited pay life insurance contact to fund your funeral expenses. Additionally, the insurance company provides an increasing death benefit to offset price inflation. The rate is is currently at 1.9% per year but is subject to change. Example – if you took out a $10,000 death benefit 10 pay policy and were averaging a 2% per year increased death benefit, at the end of 10 years your death benefit would have increased to over $12,000

This policy is guaranteed issue for people between the ages of 50-99 who have not in the last 12 months been confined to a hospital, received hospice care or been informed that they have a terminal illness or life expectancy of 12 months or less.

b. The payment plan options available do vary based on your age:

The policy provides for a 30-day free look period from the date of receipt. To ensure that you have adequate time to receive and review your contract, you are allowed 90 days from issue to make any changes to the Policy.

You may convert your Policy to a paid-up status. For the 1-Pay plan this may be done at any time during the first 11 months. For all other multi-pay plans this may be done during the first 12 months. In all cases the payoff amount will be the single premium amount, less premiums paid. If the original payment plan is a 1-Pay, no fee is charged to use this feature. For all other multi-pay plans, no fee is charged if a payoff is exercised during the first 90 days. For payoffs of 3, 5, or 10-Pay plans exercised on days 91- 365 a $150 fee is charged. After month 12, contact Customer Service for the payoff savings calculation.

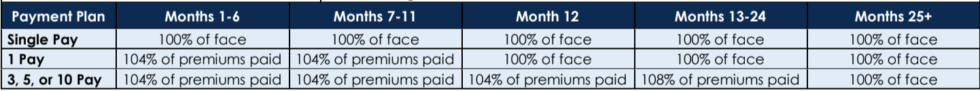

This policy does have graded benefits for the 1, 3, 5 or 10 pay. See the schedule below.

The Celebration of Life kit allows you to document your life, memories, and wishes for your loved ones to read after your passing. The kit helps you document and share stories about your family, military service, religious affiliations, organizations you were a part of, your education, valued possessions, etc. You can also answer prompts such as “My most important belief is…”, “What I wish my spouse to know…”, and “What I have learned about life…”. It also covers important information your family will need at the time of your passing, such as any real estate you may own, financial accounts, insurance policies, who you want to take care of your pets and more. The kit pulls together all of your final wishes into one place for your family.

A copy of your funeral wishes are kept by Funeral Insurance.com and an additional copy is sent over to Mark Turner from Legacy of Love who provides the concierge funeral services to your family at the time of need. You are also mailed a binder with a copy of your funeral wishes. Lastly, we offer a secure online portal for you to store and update your wishes. You can add family members or friends to have read-only access to your funeral plans so that they can access it at the time of need.

At the time of need, Legacy of Love offers your loved ones independent concierge service from Mark Turner which includes:

Call 1-800-977-0996 to get assistance.

Legacy of Love’s funeral insurance policy is protected and exempt from Medicaid consideration.